It has been a long day. You worked hard. You would like nothing better than to put your feet up in front of the television and relax with a cold beer in hand. But, you remember that your auto insurance policy is about to expire and you want to find a new company to cover your car. Hurray for the Internet. Gone are the days when you had to go in person to an insurance office during business hours and talk to a living, breathing human being. Now at the click of a mouse, you can access all the information you need to make an informed decision about what type of coverage suits your needs based on your unique circumstances. Welcome to the world of online insurance quotes. It is here to stay. Why be inconvenienced by leaving your home or workstation when all you need is Internet access and a few minutes?

You can shower, prepare a gourmet meal, make E*trades and increase your stock portfolio all while obtaining online insurance quotes thanks to the convenience of the Internet. More convenient than searching through the yellow pages under insurance and then calling each one and being on hold while waiting for a customer service rep to get you in their queue. More convenient than physically driving around from company to company and speaking with someone face to face. Think of all the time that is saved by being able to click, type, print and go about your business.

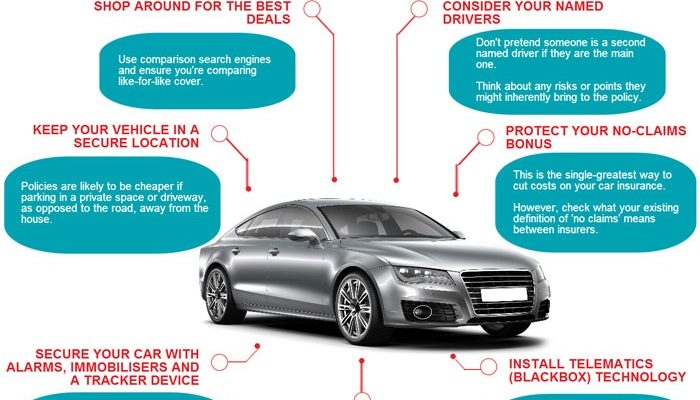

Online Insurance quotes are based upon personal information you provide. This means you should have all necessary pertinent information handy before beginning the process. Make comparisons between companies and their pricing. Weigh all conceivable options before making the commitment to a particular auto insurance company.

Do your research as to what intelligent questions you may need answers to. One size does NOT fit all when it comes to auto insurance. Going cheap may prove to be a very expensive mistake. Identify where you need the most liability and go from there. Based upon the amount of usage of your vehicle and its make and model you can make an informed decision. Explore pros and cons before making a final decision.

Act in haste and repent at leisure. Remember the point of online insurance quotes is to be convenient and cost-effective. Use that knowledge to your advantage. When you consider property damage or personal injury which one can do more financial damage in the long run? We all place different value on pain and suffering, and when it comes to loss of wages the range can be as varied as skin and hair color. But one thing is certain. Judgments and legal actions tend to follow personal injury not property damage.

It is a safe conclusion to draw that the liability coverage should be above minimum to protect your assets to the greatest extent possible. Increasing your deductible to compensate for an increase in reimbursement for personal injury related to serious accidents for other parties is cost-effective and savvy.